omaha nebraska sales tax rate 2021

Nebraska School District Property Tax Look-up Tool 1272022 The NebFile for Individuals e-file system is NOW OPEN for filling most 2021 Nebraska individual income tax. Louis Missouri 5454 percent close behind.

Nebraska Sales Tax Rates By City County 2022

FREE Nebraska Individual Income Tax E-filing The NebFile for Individuals e-file system is NOW OPEN for filing most 2021 Nebraska individual income tax returns.

. Sign up for our subscription service to be notified if there are any changes. Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St. One other major city Birmingham Alabama 10 percent also features a double-digit sales tax rate.

The NebFile system allows Nebraska resident taxpayers to file their state income tax returns FREE over the Internet.

Taxes And Spending In Nebraska

Which Cities And States Have The Highest Sales Tax Rates Taxjar

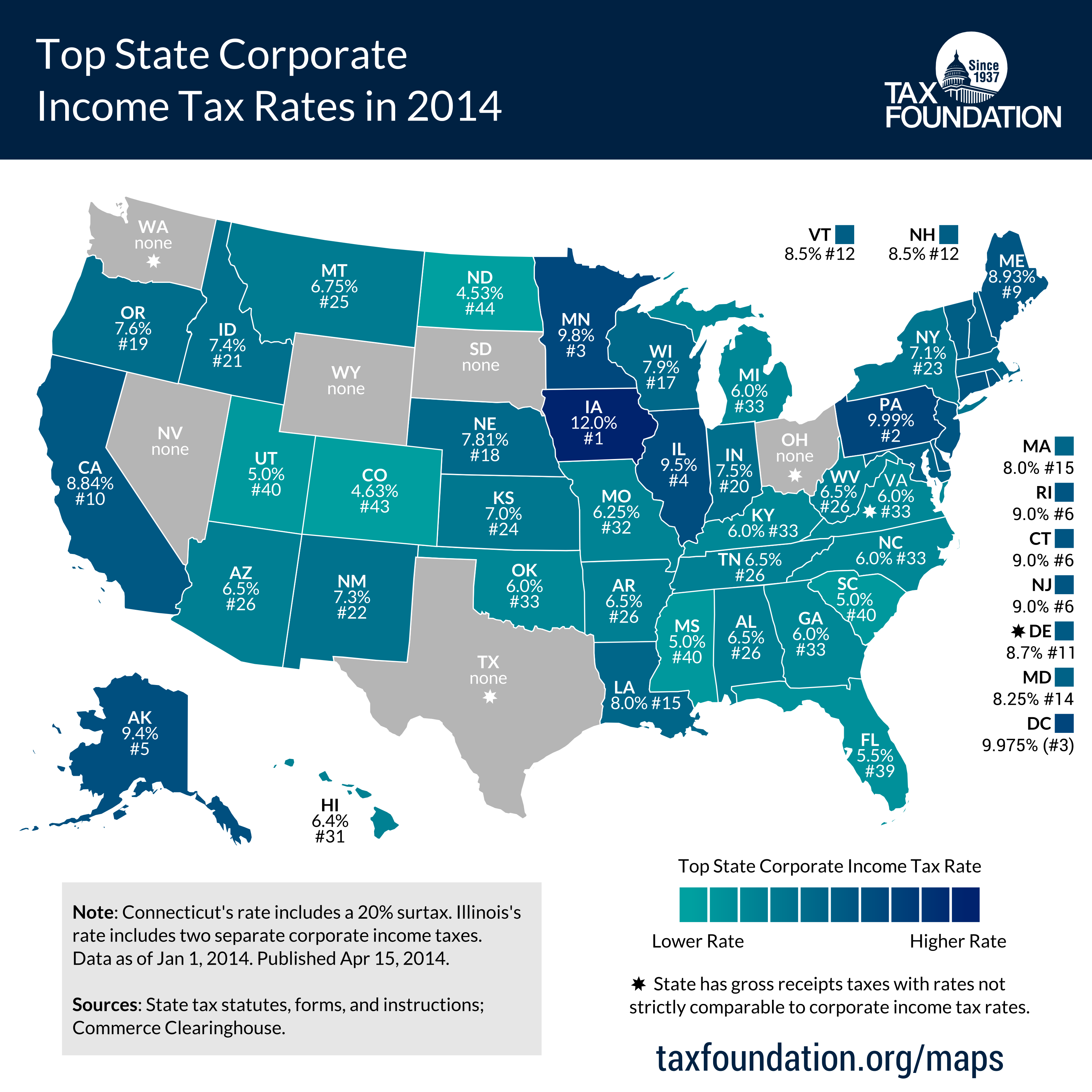

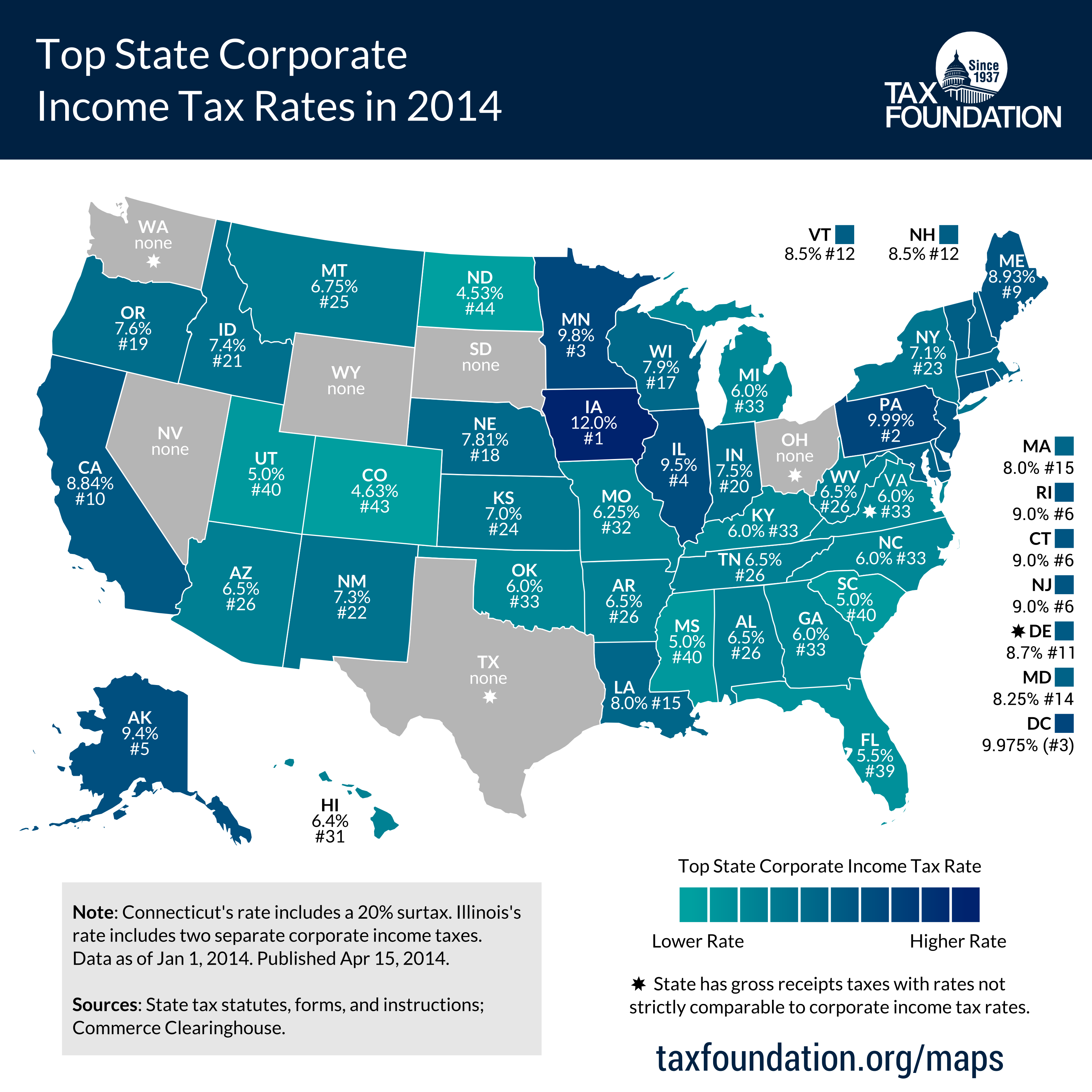

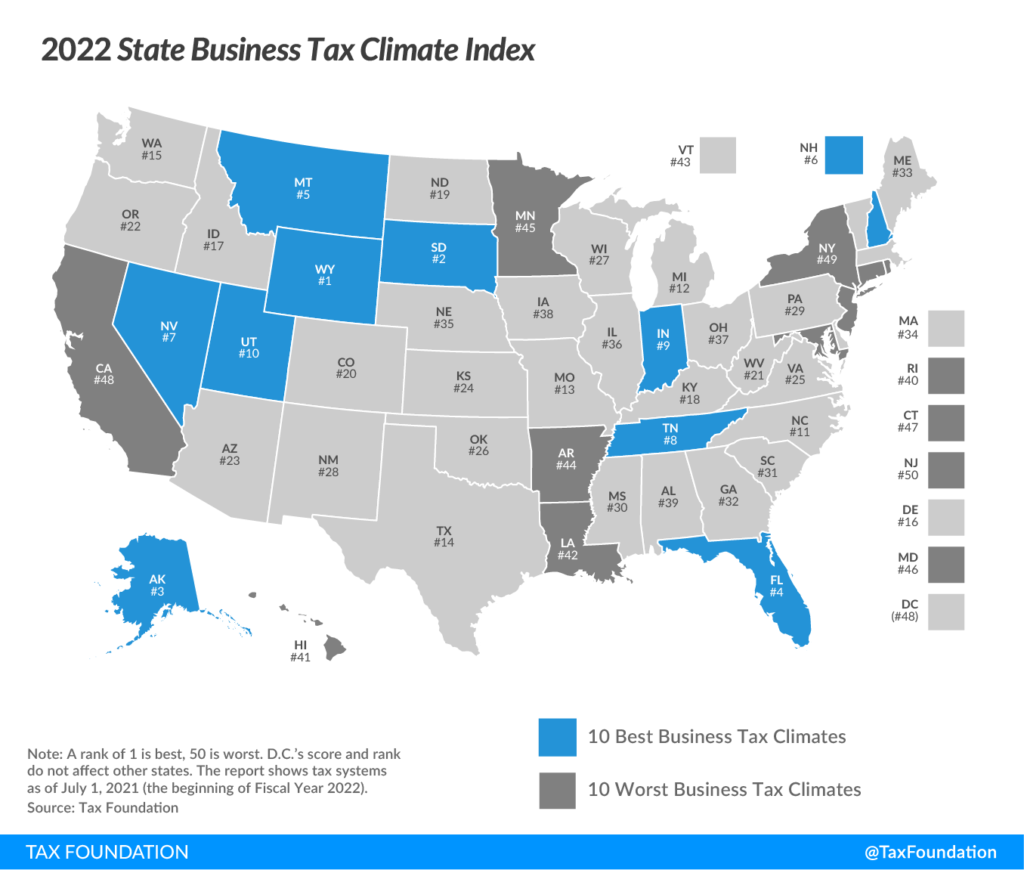

Business Tax Incentives In Nebraska Is There A Better Way Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

New Ag Census Shows Disparities In Property Taxes By State

Nebraska Sales Tax Small Business Guide Truic

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

Cell Phone Taxes And Fees 2021 Tax Foundation

Nebraska Drops To 35th In National Tax Ranking