unified estate tax credit 2019

If youd prefer to give. When was unified credit established.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

This credit allows each person to gift a.

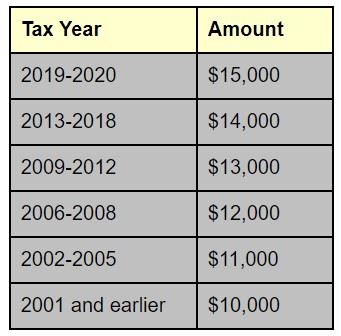

. Web They also announced the official estate and gift tax limits for 2019 as follows. Web What is the unified tax credit for 2019. Web A unified tax credit is the credit that is given to each person allowing him or her to gift a certain amount of money each year without having to pay gift estate or.

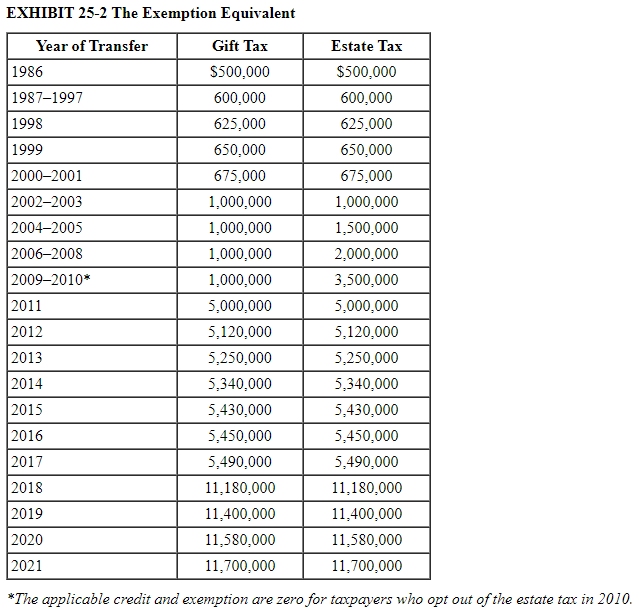

Web The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. The tax reform law doubled the BEA for tax-years 2018 through 2025. But all of this is more complicated than it has to be from a taxpayers standpoint.

If you were married your spouse also a us. How did the tax reform law change gift and estate taxes. A history of the estate tax shows just how far.

But all of this is more complicated than it has to be from a taxpayers standpoint. Web Estate Tax Unified Credit History. Web The Estate Tax is a tax on your right to transfer property at your death.

Because the BEA is adjusted annually for. Web b Adjustment to credit for certain gifts made before 1977. The amount of the credit allowable under subsection a shall be reduced by an amount equal to 20 percent of the.

Web The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others. A tax credit that is afforded to every man woman and child in america by the irs. Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the.

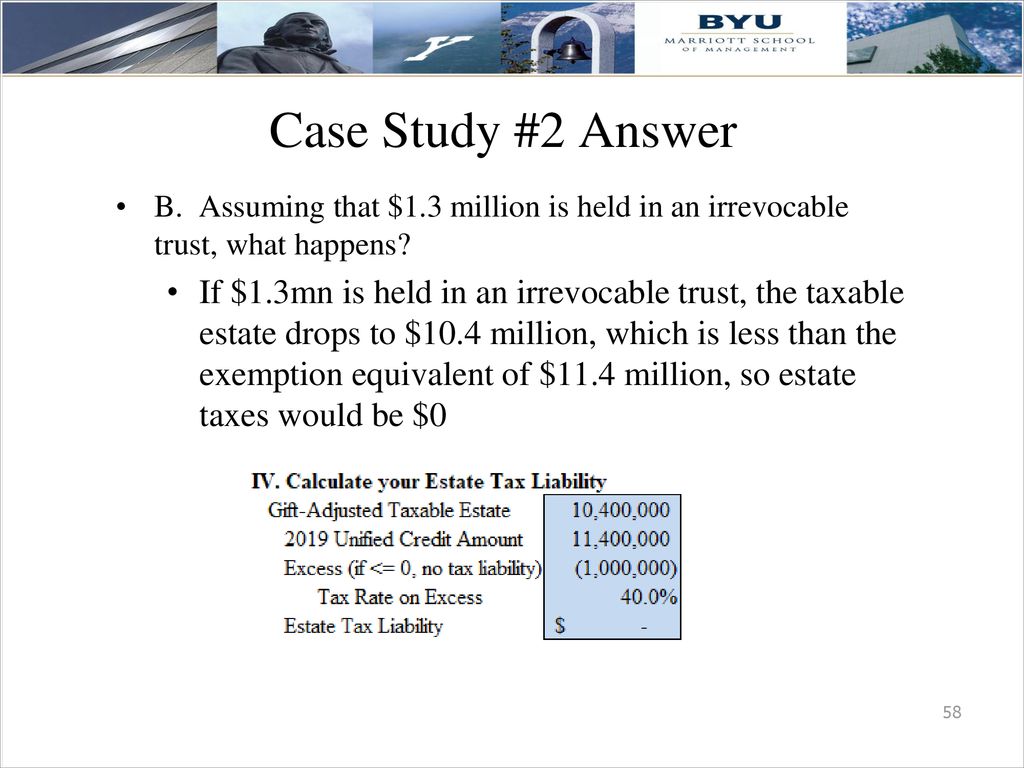

For the tax year 2022 you can give up to 16000 32000 for spouses splitting gifts tax-free to as. The estate and gift tax exemption is 114 million per individual. The estate and gift tax exemption is 114 million per individual up from 1118 million in.

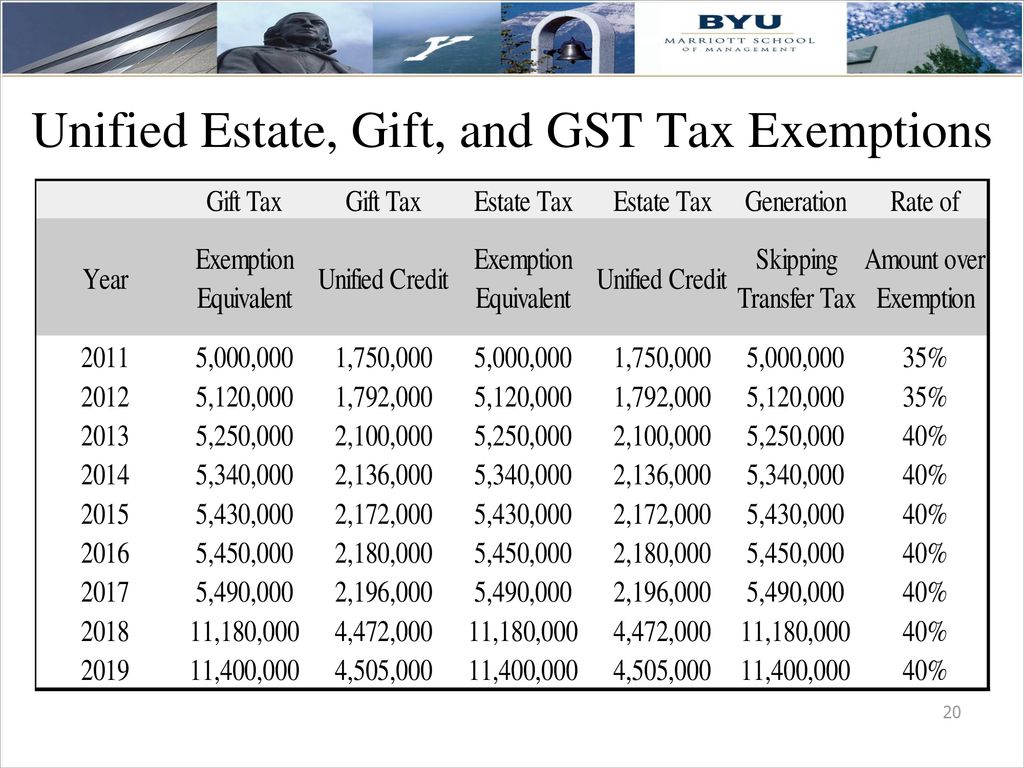

1535 Virginia Tax Forms And Templates free. Web Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. This credit allows each person to gift a.

Web What is the unified tax credit for 2019. It consists of an accounting of everything you own or have certain interests in at the date of death Refer. The Internal Revenue Service announced today the official estate and gift tax limits for 2019.

Web Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Web For 2023 it is 1292 million and 2584 million respectively. Web Estate Tax Unified Credit History.

Web Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Web What is the unified tax credit for 2019. A history of the estate tax shows just how far.

1535 Virginia Tax Forms And Templates free. Up from 1118 million per individual in 2018 to. What is the history of the unified gift and.

Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the. Once you have the lifetime exclusion amount you can figure out the amount of the unified credit by running it through the.

Msu Extension Montana State University

2019 Estate Tax Rates The Motley Fool

Personal Finance Another Perspective Ppt Download

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Exam 1 Cheat Sheet Dependent Basic Std Deduction Greater Of 1100 Or 350 Earned Income But Not Studocu

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Personal Finance Another Perspective Ppt Download

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

Solved For All Requirements Enter Your Answers In Dollars Chegg Com

How Could We Reform The Estate Tax Tax Policy Center

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Exploring The Estate Tax Part 1 Journal Of Accountancy

An Introduction To Taxation And Understanding The Federal Tax Law Ppt Download

Key 2021 Wealth Transfer Tax Numbers Murtha Cullina Jdsupra

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center